Austria¶

Configuration¶

Install the following modules to get all the features of the Austrian localization.

Name |

Technical name |

Description |

|---|---|---|

Austria - Accounting |

|

Default fiscal localization package. |

Austria - Accounting Reports |

|

Adds localized versions of financial reports |

Austrian SAF-T Export |

|

Adds the SAF-T export. |

Financial reports¶

The following localized reports are available:

SAF-T (Standard Audit File for Tax)¶

The Austrian tax office may request a SAF-T. The Austrian SAF-T Export module allows exporting the report in XML format.

Configuration¶

This section explains how to configure the database to ensure all the information required by the SAF-T is available. If anything is missing, a warning message listing which information is needed will be displayed during the export.

Company information¶

Open the database Settings. Under the Companies section, click Update Info and ensure the following fields are correctly filled in:

Address, by providing at least the following information:

Street

City

ZIP

Country

Phone

Company ID by providing your company’s tax ID

Tax ID by providing, if you have one, your UID-Nummer (including the country prefix)

Contact person¶

At least one contact person must be linked to your company in the Contacts app, and:

Ensure the contact type is set to Individual.

Select your company in the Company name field.

Provide at least one phone number using the Phone or Mobile field.

Customer and supplier information¶

Using the Contacts app, fill in the Address of any partner that appears in your invoices, vendor bills, or payments.

For partners that are companies, fill in the VAT number (including the country prefix) in the Tax ID field.

Accounting settings¶

Go to . Under the Austrian localization section, fill in the following fields:

ÖNACE-Code

Profit Assessment Method

Chart of accounts mapping¶

The Austrian SAF-T specifications define a chart of accounts (COA). All relevant accounts for the SAF-T export must be annotated with a fitting account from this COA.

The needed mapping information is supplied by adding tags to the accounts. For example, adding the

1000 tag to an account maps it (virtually) to the SAF-T COA account with the code 1000. Any

number can be used as long as there is an account in the SAF-T COA with that code.

The Austria - Accounting module adds a tag for each SAF-T COA account. Furthermore, it automatically maps many accounts from the default Austrian COA.

You can try exporting the SAF-T report to check if there are unmapped accounts (or mapped to multiple SAF-T accounts). A warning will be displayed if there is any issue with your configuration or the mapping. Clicking View Problematic Accounts lets you view them.

See also

Exporting the SAF-T report¶

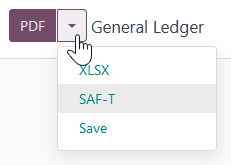

To export the SAF-T report, go to . Click the right side of the PDF button and select SAF-T.