Deferred expenses¶

Deferred expenses and prepayments (also known as prepaid expenses) are both costs that have already occurred for products or services yet to be received.

Such costs are assets for the company that pays them since it already paid for products and services but has either not yet received them or not yet used them. The company cannot report them on the current profit and loss statement, or income statement, since the payments will be effectively expensed in the future.

These future expenses must be deferred on the company’s balance sheet until the moment in time they can be recognized, at once or over a defined period, on the profit and loss statement.

For example, let’s say we pay $1200 at once for one year of insurance. We already pay the cost now but haven’t used the service yet. Therefore, we post this new expense in a prepayment account and decide to recognize it on a monthly basis. Each month, for the next 12 months, $100 will be recognized as an expense.

Odoo Accounting handles deferred expenses by spreading them across multiple entries that are posted periodically.

Note

The server checks once a day if an entry must be posted. It might then take up to 24 hours before you see a change from Draft to Posted.

Configuration¶

Make sure the default settings are correctly configured for your business. To do so, go to . The following options are available:

- Journal

The deferral entries are posted in this journal.

- Deferred Expense Account

Expenses are deferred on this Current Asset account until they are recognized.

- Deferred Revenue Account

Revenues are deferred on this Current Liability account until they are recognized.

- Generate Entries

By default, Odoo automatically generates the deferral entries when you post a vendor bill. However, you can also choose to generate them manually by selecting the Manually & Grouped option instead.

- Amount Computation

Suppose a bill of $1200 must be deferred over 12 months. The Equal per month computation recognizes $100 each month, while the Based on days computation recognizes different amounts depending on the number of days in each month.

Generate deferral entries on validation¶

Tip

Make sure the Start Date and End Date fields are visible in the Invoice Lines tab. In most cases, the Start Date should be in the same month as the Bill Date.

For each line of the bill that should be deferred, specify the start and end dates of the deferral period.

If the Generate Entries field is set to On invoice/bill validation, Odoo automatically generates the deferral entries when the bill is validated. Click on the Deferred Entries smart button to see them.

One entry, dated on the same day as the bill, moves the bill amounts from the expense account to the deferred account. The other entries are deferral entries which will, month after month, move the bill amounts from the deferred account to the expense account to recognize the expense.

Example

You can defer a January bill of $1200 over 12 months by specifying a start date of 01/01/2023 and an end date of 12/31/2023. At the end of August, $800 is recognized as an expense, whereas $400 remains on the deferred account.

Reporting¶

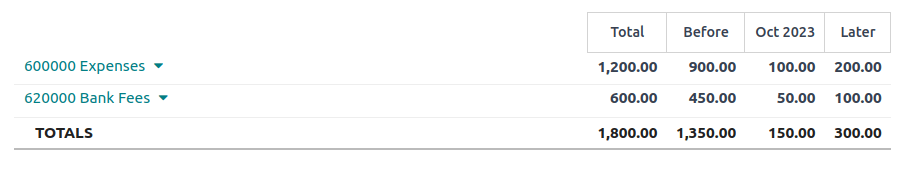

The deferred expense report computes an overview of the necessary deferral entries for each account. To access it, go to .

To view the journal items of each account, click on the account name and then Journal Items.

Note

Only bills whose accounting date is before the end of the period of the report are taken into account.

Generate grouped deferral entries manually¶

If you have a lot of deferred revenues and wish to reduce the number of journal entries created, you can generate deferral entries manually. To do so, set the Generate Entries field in the Settings to Manually & Grouped. Odoo then aggregates the deferred amounts in a single entry.

At the end of each month, go to the Deferred Expenses report and click the Generate Entries button. This generates two deferral entries:

One dated at the end of the month which aggregates, for each account, all the deferred amounts of that month. This means that at the end of that period, a part of the deferred expense is recognized.

The reversal of this created entry, dated on the following day (i.e., the first day of the next month) to cancel the previous entry.

Example

There are two bills:

Bill A: $1200 to be deferred from 01/01/2023 to 12/31/2023

Bill B: $600 to be deferred from 01/01/2023 to 12/31/2023

- In January

At the end of January, after clicking the Generate Entries button, there are the following entries:

Entry 1 dated on the 31st January:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 100 + 50 = 150 (recognizing 1/12 of bill A and bill B)

Line 3: Deferred account 1800 - 150 = 1650 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st February, the reversal of the previous entry:

Line 1: Expense account 1800

Line 2: Deferred account -150

Line 3: Expense account -1650

- In February

At the end of February, after clicking the Generate Entries button, there are the following entries:

Entry 1 dated on the 28th February:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 200 + 100 = 300 (recognizing 2/12 of bill A and bill B)

Line 3: Deferred account 1800 - 300 = 1500 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st March, the reversal of the previous entry.

- From March to October

The same computation is done for each month until October.

- In November

At the end of November, after clicking the Generate Entries button, there are the following entries:

Entry 1 dated on the 30th November:

Line 1: Expense account -1200 -600 = -1800 (cancelling the total of both bills)

Line 2: Expense account 1100 + 550 = 1650 (recognizing 11/12 of bill A and bill B)

Line 3: Deferred account 1800 - 1650 = 150 (amount that has yet to be deferred later on)

Entry 2 dated on the 1st December, the reversal of the previous entry.

- In December

There is no need to generate entries in December. Indeed, if we do the computation for December, we will have an amount of 0 to be deferred.

- In total

If we aggregate everything, we would have:

bill A and bill B

two entries (one for the deferral and one for the reversal) for each month from January to November

Therefore, at the end of December, bills A and B are fully recognized as expense only once in spite of all the created entries thanks to the reversal mechanism.