Withholding taxes¶

A withholding tax, also known as retention tax, mandates the payer of a customer invoice to deduct a tax from the payment and remit it to the government. Typically, a tax is included in the subtotal to calculate the total amount paid, while withholding taxes are directly subtracted from the payment.

Configuration¶

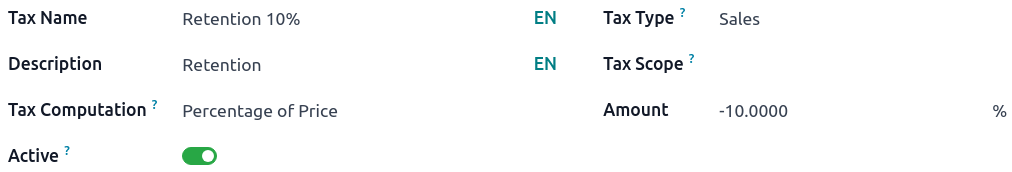

In Odoo, a withholding tax is defined by creating a negative tax. To create one, go to and, in the Amount field, enter a negative amount.

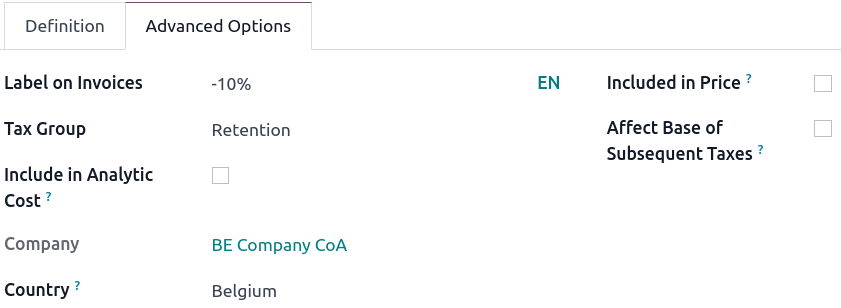

Then, go to the tab and create a retention Tax Group.

Tip

If the retention is a percentage of a regular tax, create a Tax with a Tax Computation as a Group of Taxes. Then, set both the regular tax and the retention one in the Definition tab.

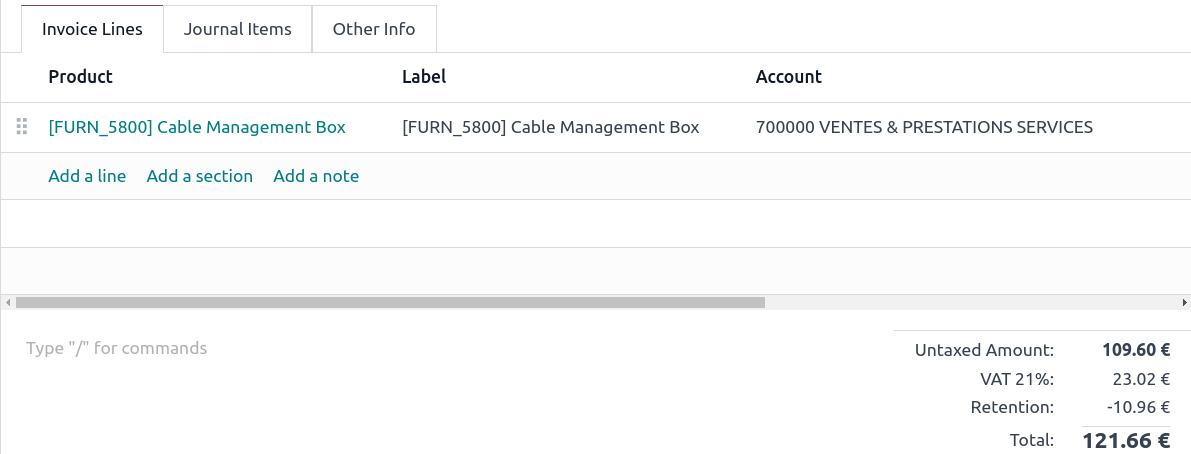

Retention taxes on invoices¶

Once the retention tax has been created, it can be used on customer forms, sales orders, and customer invoices. Several taxes can be applied on a single customer invoice line.

See also